📌 MAROKO133 Breaking startup: 🚀 Nusantara Lima lifts off. 💸 Accion closes $61.6m f

Dear subscribers,

We’re back with a concise briefing for founders, investors, VCs, and regulators across Indonesia, the region, and beyond. Inside: the week’s essential shifts in capital, expansion, partnerships, and policy—distilled for fast decision-making. Enjoy!

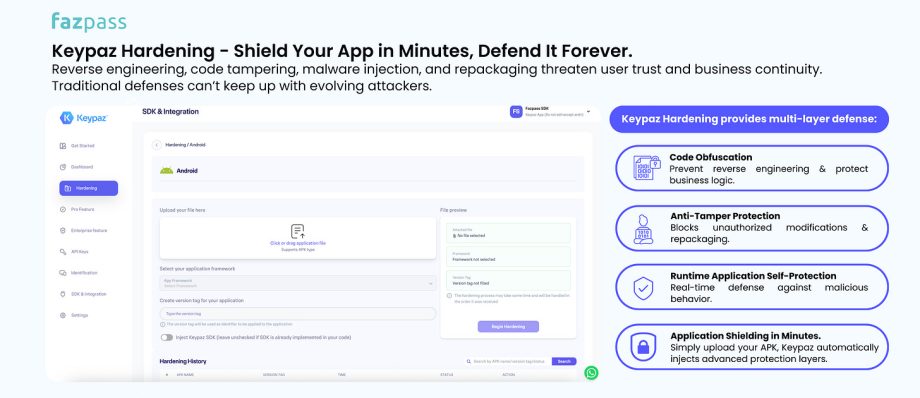

This week’s newsletter is sponsored by Fazpass. Shield Your App in Minutes, Stay Protected Forever.

Keypaz Hardening makes reverse engineering, tampering, and malware a thing of the past. With instant multi-layer defense code obfuscation, anti-tamper, runtime self-protection, and one-click shielding you keep your app, your users, and your business safe. [Try Now!]Best regards,

The DailySocial Team

🚨 What’s New

-

Indonesia launched the Nusantara Lima (N5) satellite on 10 Sep 2025 aboard a SpaceX Falcon 9 from Cape Canaveral. Owned by PT Satelit Nusantara Lima (a PSN subsidiary) and developed with Boeing and Hughes, N5 operates at 113°E with 160 Gbps capacity—the largest in Southeast Asia. The mission is to extend high-speed internet across the archipelago to enable distance learning, telehealth, and MSME digital participation. Early local impacts—such as service improvements at Airu Community Health Center (Papua) and “digital village” pilots in East Java—point to better public services and broader economic inclusion. [Read more]

-

Bali-based Bliink unveiled a travel-management platform for MSMEs. A companion whitepaper highlights that 97% of Indonesian businesses are MSMEs, most still managing travel manually—leading to up to 30% cost leakage, 60% higher last-minute fares, 1 in 4 employees misclassifying personal expenses, and hundreds of hours lost to manual processes. CEO Larry Chua targets up to 30% savings via corporate fares, policy controls, integrated booking-to-reimbursement (cutting admin time by up to 50%), pay-as-you-go billing, and 24/7 human + AI support. [Read more]

-

Investors in Kopi Kenangan—including GIC and Peak XV Partners—are exploring partial stake sales with a financial adviser, according to sources. Talks are early and may not result in a deal or defined stake size. A transaction could value the grab-and-go coffee chain at US$1.2–1.4B (subject to change). Founded in 2017, the company operates 800+ outlets across 45 Indonesian cities, with offices in Jakarta, Singapore, and Malaysia. [Read more]

-

Awanio partnered with Techna-X Berhad and PMBI Technology Sdn. Bhd. (Malaysia) to advance Indonesia’s digital sovereignty through technology transfer, talent development, and a regional innovation hub spanning cloud, virtualization, and AI. The collaboration covers training curricula, Indonesia–Malaysia talent exchanges, and capacity-building for faster, safer cloud adoption in public and private sectors. CEO Irfan Yuta Pratama aims to boost local competencies and regional go-to-market, nurturing competitive “local hyperscaler” capabilities. [Read more]

👏 What’s Exciting

Carro lines up dual-listing options and Australia expansion

Carro (Temasek/SoftBank-backed) is evaluating a potential dual listing while preparing an Australia launch and 2–3 acquisitions as early as next quarter, said CEO Aaron Tan. The firm is in talks with banks including HSBC and UBS (no advisers appointed yet); possible venues include the U.S., Hong Kong, and Singapore. Tan highlighted a path to US$120–150m EBITDA next year, aided by 20–30% tech-cost reductions from AI adoption. The push follows last year’s Hong Kong entry via the Beyond Cars acquisition and would bring Carro’s full service suite to Australia.

Accion closes US$61.6m early-stage fintech fund

Accion closed Accion Venture Lab Fund II (rebranded to Accion Ventures) at US$61.6m to back ~30 inclusive-fintech startups serving MSMEs and low-income customers across Africa, South & Southeast Asia, Latin America, and the U.S. LPs include FMO, Proparco, ImpactAssets, Ford Foundation, MetLife, and Mastercard. In Indonesia, Accion has previously supported Finfra, Amartha, Semaai, MyRobin, Fairbanc, and Bababos—signaling continued interest in embedded finance and alternative-data solutions, alongside hands-on operational support and networks.

Indonesia’s podcast audience shifts to video

Populix research presented at Radiodays Asia (3 Sept 2025) shows a decisive shift toward video podcasts in Indonesia<…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Eksklusif startup: 🧩SaaS leader Mekari acquires Desty. 🏆Sea Ltd back o

Dear subscribers,

Indonesia ended the last week in horror as riots erupts across Indonesia driven by political demonstration that turned fatal. The whole weekend was a terrorizing one as riots spreads to smaller regions. Although most of the riots have died down, this week still starts in a rather fearful mood. We wish everyone safe and hope the situation improves soon for everyone

And now, this week’s highlights: funding (Pintarnya, Blitz, Kozystay), platform moves (Mekari, Amartha), and profitability signals (Wagely). Around the region, SeaLtd retakes the top spot by market cap, Atome scales profitably, and ZUZU raises to double-down on AI. Payment rails and rules continue to strengthen supporting Southeast Asia fintech’s march toward ~US$1.1T in 2025.

This week’s newsletter is sponsored by Keypaz, an advanced device-level fraud prevention system using fingerprinting, real-time monitoring, and AI risk scoring. Keypaz blocks high-risk devices across billions monitored globally, reducing operational costs, protecting brand reputation, and securing legitimate user experiences. [Try Now].

Keypaz, pioneer of proactive digital fraud defense!

Best regards,

The DailySocial Team

🚨 What’s New

-

Funding round-up (ID ecosystem):

-

Pintarnya, Indonesia’s jobs & worker-finance platform raised a US$16.7M Series A led by Square Peg, Vertex Ventures, and East Ventures to deepen its tech stack and expand worker financing. Traction to date: 10M+ job seekers, 40K+ employers, nearly 5× YoY revenue growth, breakeven targeted this year, and potential regional expansion. [Read more]

-

Blitz Electric Mobility, Indonesia-based EV logistics enabler closed Pre-Series A led by Vynn Capital with Iterative Capital and new investors including Balaji Srinivasan. In 2024: 3× revenue growth, 70% lower burn. Cumulative stats: 14M+ deliveries, 1,000+ e-motorbikes, 220M km traveled, operations in 30 cities. Indonesia’s courier market is projected to grow from US$7.86B (2025) to US$11.15B (2030). [Read more]

-

Kozystay acquires BaliSuperHost. Shortly after a Series A led by Integra Partners with Cercano Management and Intudo, Kozystay bought BaliSuperHost, the island’s largest premium villa operator. The combined group becomes Indonesia’s largest tech-enabled short-term rental manager with 1,000+ units across apartments, villas, and aparthotels. [Read more]

-

-

Mekari (Indonesia’s most valued SaaS startup) acquired Desty, an omnichannel commerce platform used by thousands of merchants. The move extends Mekari from back-office tools into integrated digital commerce—unifying inventory, orders, warehousing, products, finance, and customer comms in one system. Desty (founded 2021) adds landing pages, online stores, POS, and omnichannel orchestration. Expect faster merchant growth and stronger positioning as an end-to-end SME platform in Indonesia. [Read more]

-

Amartha becomes Amartha Financial Group (ID) to expand beyond micro-lending into payments and micro-investment to strengthen village-level economies (50,000 villages). With backers like IFC and Women’s World Banking, Amartha applies AI-based credit scoring from a decade of community data to deliver inclusive products distinct from urban-centric fintechs—while advancing financial literacy and inclusion for strategic segments such as women. [Read more]

-

Earned wage access platform Wagely reports full profitability, with US$120M+ disbursed across 3.5M transactions and loss rates <0.5%. With 200+ employers (incl. Adira Finance, BAT), Wagely serves 1M+ workers in Indonesia, positioning EWA as an employee benefit (not a loan) to drive recurring revenue. Beyond EWA, Wagely added savings and budgeting, and expanded in Bangladesh. Wagely sees room to apply generative AI for efficiency and worker financial literacy. [Read more]

👏 What’s Exciting

-

Sea Ltd. back at #1 by market cap (SEA)

Sea reclaimed the title of Southeast Asia’s most valuable public company at ~US$111B, edging past DBS (~US$110.3B) after a 300% rally fueled by Shopee outperformance. Cost discipline drove profitability; SPX Express logistics and digital finance are long-term levers. DBS also rallied ~65% on lending and wealth management strength but ceded the top spot. -

Atome Financial delivers profitable scale

2024 operating income: US$236M (+63% YoY); <a href="https://www.atome.id/news/atome-financial-posts-record-us236m-operating-income-marks-full-year-profi…Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!