📌 MAROKO133 Update crypto: Abu Dhabi, Binance, World Liberty Financial – The Maste

After President Trump pardoned CZ this morning, World Liberty Financial’s WLFI token jumped over 14%. Although the former Binance CEO seems unrelated to this Trump family venture, the rally highlights key dynamics.

In essence, all these parties have become intertwined and formed a symbiotic relationship. On paper, Binance and the US President’s crypto empire can benefit from each other’s success.

Binance and Trump Explained

This morning, the crypto space was rocked by President Trump’s decision to pardon CZ, the former CEO of Binance.

Since his former organization and the Trump family’s business interests are thoroughly entangled, this has raised community fears that other firms will try to bribe the President to receive favorable treatment.

However, calling this a case of outright bribery might be a little oversimplified. Trump and Binance both benefit symbiotically from continued commerce, and WLFI’s price spike today clearly illustrates that.

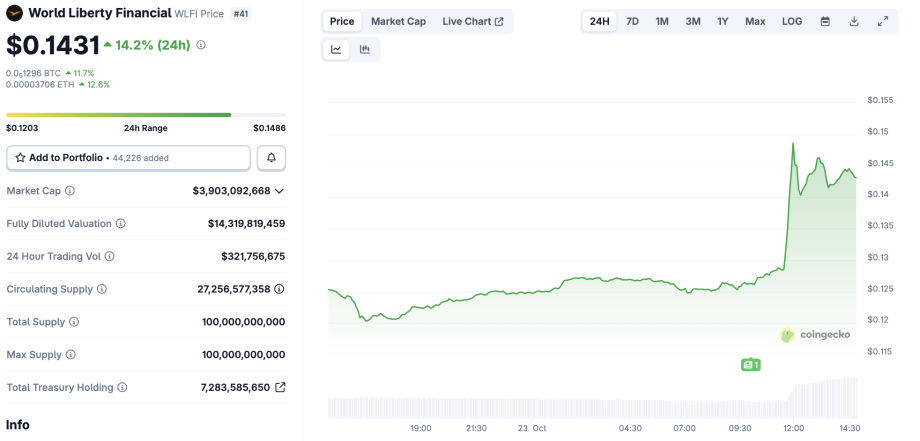

Although World Liberty is theoretically uninvolved in the pardon, it spiked over 14% today:

Coffeezilla, a prominent crypto sleuth, pointed to a specific example highlighting this symbiotic relationship.

MGX, a UAE-based sovereign wealth fund, invested $2 billion into Binance this March.

But, this deal took a brief detour through the Trump family’s DeFi venture, converting the money into USD1, which it then gave to Binance.

A Puzzle That Seamlessly Fits Together

The deal between Abu Dhabi’s MGX fund and Binance is not unconventional, but it’s how the deal was completed. MGX could have given the fund to Binance in any currency. It could have been USDC or USDT, the two most prominent and well-established stablecoins.

But this detour provided extra benefits while tying the two entities together. For World Liberty Financial, its new stablecoin got $2 billion in fresh liquidity shortly after its launch.

It will also gain between $60 million and $80 million in annual yield, provided that Binance doesn’t try to redeem the funds.

Binance, meanwhile, has thus gained a direct financial interest in ensuring that the Trump family stablecoin maintains its peg. This could explain why the crypto community considers this pardon a bullish case for the WLFI token.

If we can assume that CZ’s pardon is the main benefit for Binance, his personal stature still makes this a sound investment. Once he returns to legal business ventures in the US, CZ could recover those $2 billion quickly.

Moreover, an ongoing relationship with the Trumps will doubtlessly involve future beneficial opportunities.

Although MGX could’ve simply given the money to Binance directly, involving USD1 and the Trump family cemented valuable ties.

The fund, for its part, cited World Liberty’s “compliance history” in choosing the asset. But given that World Liberty Financial is only a year old, other stablecoin providers likely hold a much more effective regulatory history.

CZ conducted business with this fledgling crypto empire on several key occasions, but the MGX deal highlights all the relevant dynamics. All these factors still apply in October. In other words, who benefited from the pardon? Everyone.

If proven, this level of corruption could be beyond unprecedented in the entire history of the United States. Ignoring potential market instability, relationships like this fundamentally undermine the fabric of society and political life.

The post Abu Dhabi, Binance, World Liberty Financial – The Mastermind Trio Behind Trump’s CZ Pardon? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: China Is Third-Largest Contributor To Global Bitcoin

China was once the undisputed center for Bitcoin mining. Known for its cheap power and access to leading hardware manufacturers, all of this positioned China as a leader in global Bitcoin mining.

However, this changed when mining was banned by the Chinese government in 2021. In late September 2021, the People’s Bank of China (PBOC) further banned all cryptocurrency transactions. The PBOC cited the role of cryptocurrencies in facilitating financial crime as well as posing a growing risk to China’s financial system.

Fast-forward to today—despite the government’s strong efforts to weed out all crypto miners, many have found ways to continue operations. According to the Q4 2025 update of Luxor’s Global Hashrate Map, China currently accounts for 14.05% of Bitcoin’s total compute power, or roughly 145 exahashes per second (EH/s). This is a modest rise from 13.8% in Q3.

China Leads in Global Bitcoin Mining

Kaan Farahani, research associate at Luxor, told Cryptonews that Luxor’s Global Hashrate Map estimates the geographic distribution of Bitcoin mining activity across the world.

“The map provides weighted hashrate concentration across regions by incorporating mining pool data, ASIC trading flows, and firmware adoption trends,” Farahani said.

Based on the recent data, China is the third-largest contributor globally to Bitcoin mining, just behind the U.S. and Russia.

Luxor’s findings do not show where specifically the hashrate resides. According to Miner Weekly, multiple sources across the ASIC supply chain have pointed to one possible destination, which is Xinjiang. The region’s relative isolation and abundant energy resources have made it a longtime hub for Bitcoin mining before China’s ban in 2021.

China Reveals Underground Bitcoin Mining Operations

While China’s continuation of Bitcoin mining may not come as a complete shock, this illustrates the murky, underground nature of the mining industry.

Kent Halliburton, CEO and co-founder of Bitcoin mining platform Sazmining, told Cryptonews that he is not surprised to see mining still occurring in China.

“This is one of the beauties of Bitcoin mining. It’s a cypherpunk way to generate Bitcoin, meaning that as long as you have electricity and hardware, you can generate Bitcoin for yourself. It’s tough to shut down mining on the outskirts, and that is why I believe the hashrate we see in China continues to exist,” Halliburton said.

Other regions where Bitcoin mining is considered illegal are also showing signs of growth. For example, Farahani noted that Luxor’s Hashrate Map gives insight into Iran, estimating that around 8 EH/s of hashrate is operational in the region as of Q4-2025. This represents 0.75% of global market share.

According to Halliburton, Iran is another good example of where Bitcoin mining has been occurring, but has largely been illegal. Iran initially banned Bitcoin mining in May of 2021 for four months. The region’s second ban took place in December 2021. Prior to this, Iran’s bitcoin mining was estimated to make up between 4% and 8% of the global BTC network.

“Essentially, any country with stringent controls on capital outflows is likely to restrict or attempt to ban Bitcoin mining,” Halliburton said. “But if you have power, you can generate Bitcoin as long as you have the right hardware to harness it. That means that if you’re trying to stem the flow of capital from leaving your country, you have a way to do that with Bitcoin mining.”

China’s Concerning Mining Infrastructure Empire

In addition to mining, recent findings from Bitcoin solutions manufacturer Auradine found that over 95% of Bitcoin ASIC mining equipment is manufactured by Chinese firms like Bitmain, MicroBT, and Canaan. Auradine’s report notes that Chinese equipment manufacturing poses a major threat to U.S. national security and key infrastructure.

Sanjay Gupta, chief strategy officer at Auradine, told Cryptonews that China’s mining infrastructure operations are concerning for a number of reasons. For instance, he mentioned that there are over a million Chinese-based Bitcoin mining machines with foreign firmware connected to the U.S. electrical grid.

“This poses a potential serious cybersecurity risk to the electrical grid across multiple states,” Gupta said. “If there is embedded software in these Chinese miners that is triggered for a coordinated cyber attack to drive a large number of miners to simultaneously go in rapid over- or underdrive, this could cause a catastrophic failure of the U.S. electrical grid.”

Gupta added that the BTC mining hardware supply being highly concentrated poses a major risk of a potential 51% takeover of the bitcoin protocol in a hostile geopolitical situation. This has become even more of a threat with the recent tariffs imposed on China by President Trump, which could rise to 155% in the coming weeks.

“This could cause a dramatic impact on the value of BTC and ripple effect in financial markets,” Gupta remarked.

Is China A Threat To Bitcoin Miners?

It’s clear that Bitcoin mining and manufacturing continue to take place in China despite bans. So what does this mean for miners based in regions where BTC mining is considered legal?

According to Farahani, Luxor is unaware of challenges or threats based on China’s mining operations.

On the other hand, Gupta believes that Chinese firms supplying mining equipment will create complexities for other regions….

Konten dipersingkat otomatis.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!