📌 MAROKO133 Hot crypto: BNB Price Hits 7-Month Low—Will 1 Million New Addresses Sp

BNB has experienced a sharp correction, with the price falling from $900 to near $700 in recent sessions. The decline erased months of gains and pushed the asset to a seven-month low.

While selling pressure has dominated, the downturn may not be finished unless holder behavior shifts. Emerging on-chain trends suggest conditions could still change.

BNB Is Observing A Flood Of New Holders

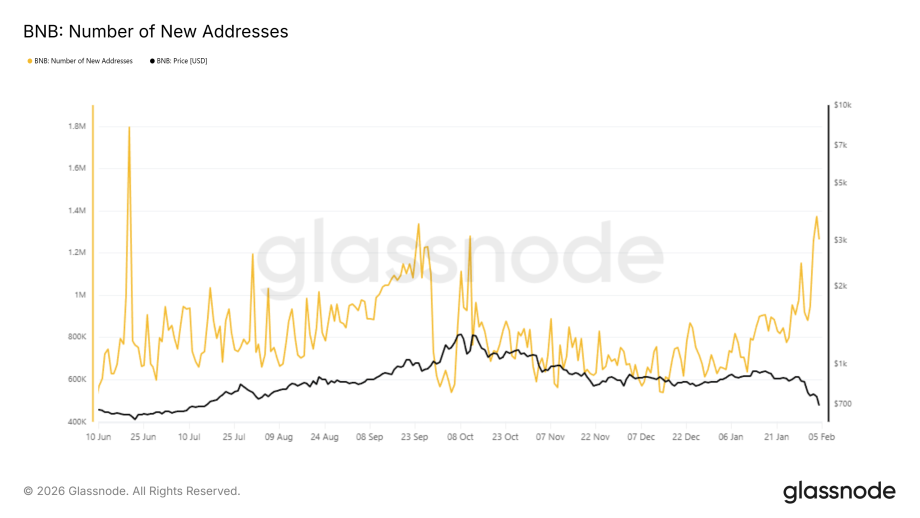

BNB’s network activity has shown notable strength despite the price crash. New address creation has risen consistently over recent days, peaking near 1.3 million additions. Even now, the network continues to add more than 1 million new addresses daily. This growth signals sustained interest during a volatile period.

New addresses are significant because they often represent fresh capital entering the ecosystem. While existing holders are facing selling pressure, new participants can help absorb supply. Historically, strong network growth during corrections has supported stabilization. For BNB, this influx may counterbalance distribution if buying interest persists.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Despite improving on-chain participation, derivatives data remains bearish. Futures market positioning shows a clear skew toward downside risk. Liquidation maps highlight approximately $43 million in short liquidation leverage compared with just $6 million on the long side. This imbalance reflects strong bearish conviction among leveraged traders.

Such positioning often amplifies volatility. If price continues to decline, long liquidations could accelerate losses. The map shows the largest cluster of long contracts sitting at $682, BNB’s next support. Losing this support would also trigger $3.07 million in long liquidations. For now, the dominance of bearish exposure suggests caution.

BNB Price Correction Could Continue

BNB price has declined 22.5% over the past seven days and is trading near $698 at the time of writing. Technical indicators point to continued weakness. The Fibonacci Extension tool identifies $682 as the next major support level, making it a critical zone for near-term price stability.

If broader market conditions remain bearish, downside risks increase. Continued liquidations or heightened volatility could push BNB below $682. A breakdown there would likely send the price toward $650 or lower. Such a move would deepen losses and reinforce bearish sentiment among short-term investors.

A recovery scenario depends on capital inflows offsetting bearish pressure. If demand strengthens, BNB could reclaim $735 and advance toward $768. Flipping the latter into support would invalidate the bearish thesis. Under that outcome, BNB price may recover toward $821, signaling renewed confidence.

The post BNB Price Hits 7-Month Low—Will 1 Million New Addresses Spark a Rebound? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Eksklusif crypto: Shiba Inu Price Prediction: 9,000% Liquidation Imbal

After chasing a bottom, a sharp 8,972% liquidation imbalance may have just sent bulls packing as a death cross points to more than just a brief disruption to bullish Shiba Inu price predictions.

Even after the tenth-largest crypto liquidation event on record, bulls still have it rough as the meme coin struggles to find its footing.

Of the $4.96 million in early Wednesday afternoon liquidations, roughly $18,710 came from longs while shorts lost just $208 as traders misplaced hopes of a buy-the-dip event.

Those who positioned themselves for a bounce missed one key trend indicator: the short-term trend of the 20-day SMA now underperforms the mid-term 50-day SMA, confirming a downtrend.

While liquidation events often reset the market by clearing excess leverage and creating a firmer footing, this setup points to deterioration rather than renewal. Structural breakdowns of this kind tend to invite further downside, not relief rallies.

That weakness exposes Shiba Inu’s core vulnerability: adoption. With no meaningful use case to anchor demand, SHIB remains almost entirely reliant on speculative flows

Without a fundamental backbone to absorb sustained selling pressure, Shiba Inu lacks a clear means to fend off a collapse.

Shiba Inu Price Prediction: Is This the Moment SHIB Collapses?

While there has been a clear breakdown of trend, the Shiba Inu price has yet to lose a key bull market proving ground, all-time lows at $0.000006.

This level has consistently marked pivots into bullish phases across previous market cycles, and momentum indicators suggest it may still carry the same historical significance.

The RSI’s breach far below the 30 oversold threshold suggests capitulation may be setting in, often an indicator of seller exhaustion and a prelude to a reversal.

The MACD reads similarly. It continues to close in on a golden cross above the signal line, painting the liquidation event as a short-term setback.

A bounce here could put a year-long falling wedge pattern back on track, eying a potential 450% return to $0.000033 highs if its key breakout threshold at $0.00001 can be reclaimed as support.

Still, the breakdown scenario remains. With limited historical support to cushion further downside, a break below all-time lows could see a 60% pattern breakdown to $0.0000025.

Maxi Doge: Shiba Inu Might Not Be the Right Play

Those who jump to legacy Doge tokens may be playing the game all wrong. When the bull market hits, capital almost always concentrates on one new Doge meme token.

The pattern is clear. Dogecoin ran first, Shiba Inu was next in 2021, followed by Floki, Bonk, Dogwifhat, and Neiro. Every bull cycle eventually crowns a new Doge-inspired frontrunner.

This time around, Maxi Doge ($MAXI) is tapping into those early Dogecoin vibes with a community built around sharing early alpha, trading ideas, and competitive engagement.

Participation is at its core. Weekly Maxi Ripped and Maxi Pump competitions reward top performers with leaderboard recognition, incentives, and bragging rights.

The hype is already showing in the numbers. The $MAXI presale has raised almost $4.6 million, while early backers are earning up to 68% APY through staking rewards.

For those who missed the Doge wave before, Maxi Doge could be the next chance to catch a meme coin before it enters the mainstream.

Visit the Official Maxi Doge Website Here

The post Shiba Inu Price Prediction: 9,000% Liquidation Imbalance Hits After Death Cross – Is SHIB About to Collapse? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!