📌 MAROKO133 Breaking crypto: Nearly $5 Billion Bitcoin and Ethereum Options Expire

Almost $5 billion in Bitcoin and Ethereum options are set to expire on November 14, 2025, at 8:00 UTC on Deribit. These options expiry could shake the prices of BTC and ETH, potentially moving them toward their respective strike prices as expiration approaches.

Today’s expiry is slightly lower than last week’s $5.4 billion, but the stakes are higher today as the market shows weakness. Therefore, traders and investors should closely watch max pain levels and positioning, both of which could impact short-term price action.

Bitcoin Options Market Shows Cautious Optimism

Bitcoin options positioning highlights renewed caution after the pioneer crypto dipped to levels below $100,000 for the second time in a week.

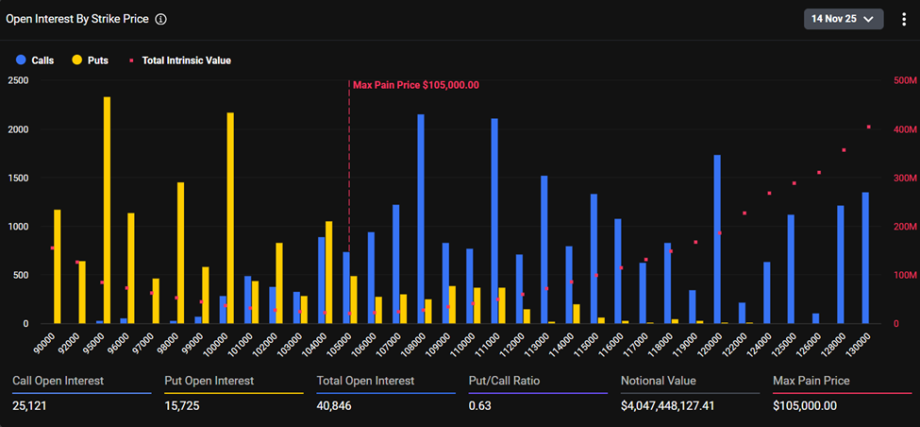

Data on Deribit shows that the maximum pain sits at $105,000, where most traders are bound to suffer the most losses as the options near expiration.

Meanwhile, the Put-to-Call ratio (PCR) is 0.63, indicating that there are fewer put options being traded than call options. This inclination suggests a bullish or optimistic market sentiment, as traders are placing more substantial bets on the market to rise.

As of this writing, Bitcoin was trading for $99,092, down by almost 3% in the last 24 hours. Therefore, the bullish bets align with the maximum pain theory, which states that prices tend to move toward their maximum pain (strike price) levels due to the influence of smart money.

A closer look at the chart reveals active hedging, rather than panic, with open interest concentrated near the $95,000 and $100,000 puts (yellow vertical bar) and the $108,000 and $111,000 calls (blue vertical bars), making these key battlegrounds as expiration nears.

Total open interest stands at 40,846 contracts, with calls (25,121) outnumbering puts (15,725). The notional value exceeds $4.04 billion, reflecting the magnitude of this expiry.

Bullish Sentiment Seen in Ethereum Positioning

Ethereum options maintain a defensive stance, trading near $3,224 as of this writing, with max pain close to $3,500. Ethereum options’ notional value sits above $730 million.

The put/call ratio is 0.64, slightly higher than that of BTC, suggesting strong bullish sentiment in the market. This indicates that traders are purchasing significantly more call options than put options, anticipating future price increases.

Indeed, the chart above shows call options at 142,333, against only 90,515 put options, translating to a 1.5x+ difference. The total open interest is 232,852.

Meanwhile, today’s options expiry comes amid broader market chaos that goes beyond Bitcoin’s dip below $100,000. Analysts at Greeks.live highlight catalysts such as the recently resolved US government shutdown.

“The US government ended an unprecedented 43-day shutdown, during which a significant amount of economic data was not released on schedule, forcing macroeconomic analysis to rely heavily on projections. The latest CPI data was also not published, significantly amplifying the importance and uncertainty surrounding the next release, as it grants the data agency greater “maneuvering room,” they wrote.

However, they highlight the December Federal Reserve interest rate meeting as the most pivotal event, amid rising uncertainty in macroeconomic data, geopolitical tensions, and the AI boom.

The analysts also note that both open interest (OI) and trading volume continue to rise in the options market, with a notable increase in out-of-the-money option trades.

This indicates growing divergence among market participants regarding future outcomes, reflected in slight increases across major implied volatility (IV) maturities.

“Block trades have also become more active, skew is moving toward equilibrium, and the short-term curve has become more fragmented,” they explained.

Taking all these factors together, they collectively signal heightened market uncertainty about near-term price movements. Thus, a plausible “reason” emerges as a trigger for a market reversal.

Traders should therefore brace for volatility as these options near expiration, but understand that stability comes after, as the markets adjust to the new trading environment.

The post Nearly $5 Billion Bitcoin and Ethereum Options Expire Today Amid A Market on Edge appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: [LIVE] Crypto News Today: Latest Updates for Nov. 14,

Crypto markets slid sharply on Nov. 14, with BTC dropping below $100,000 and ETH plunging more than 6%, as most major sectors posted 2–7% losses. NFTs, Layer 1s, DeFi, CeFi, and Meme tokens all traded lower, though pockets of strength emerged in STRK, MOG, and TEL. Despite the broad downturn, on-chain flows suggest institutions may be accumulating: Anchorage Digital has received 4,094 BTC (≈$405M) over the past nine hours from Coinbase, Cumberland, Galaxy Digital, and Wintermute, hinting that large players are buying the dip even as retail sentiment weakens.

But what else is happening in crypto news today? Follow our up-to-date live coverage below.

The post [LIVE] Crypto News Today: Latest Updates for Nov. 14, 2025 – Market Bleeds as Bitcoin Slips Under $98K; Anchorage Scoops Up 4,094 BTC Amid Selloff appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!