📌 MAROKO133 Update crypto: Why Is The Crypto Market Down Today? Hari Ini

The total crypto market cap (TOTAL) and Bitcoin (BTC) slipped on the charts today following the University of Michigan’s consumer sentiment index, which dropped to 50.3 in November 2025, its second-lowest reading ever.

With US stock markets closed, cryptocurrencies bore the impact of heightened risk aversion, with altcoins like Filecoin (FIL) falling by 25% in the last 24 hours.

In the news today:-

- Hyperliquid is testing a BorrowLendingProtocol (BLP) on its Hypercore testnet, hinting at plans to launch a native money-market layer. The feature currently supports USDC and PURR, marking the platform’s first step toward enabling on-chain borrowing and lending.

- Trump Media and Technology Group has revealed holdings of over 11,500 Bitcoin worth $1.3 billion, making it a major corporate BTC holder. The company adopted Bitcoin as a reserve asset to reduce reliance on traditional banks and also owns $110 million in Cronos (CRO) tokens.

The Crypto Market Is Moving Sideways

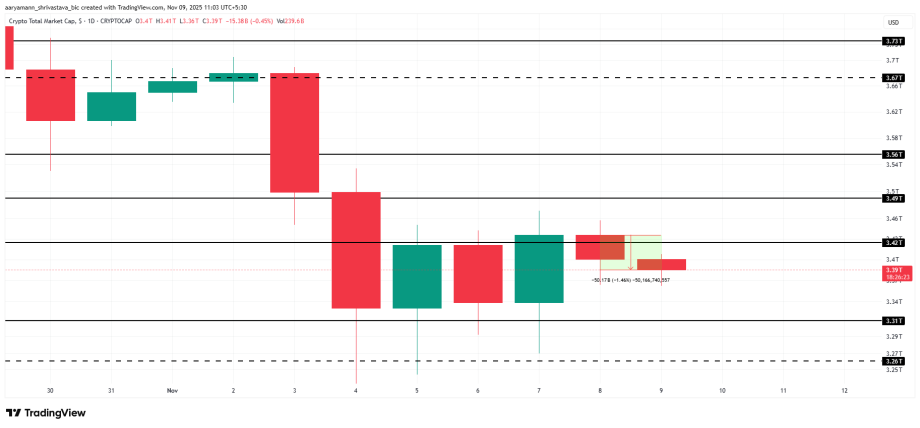

The total cryptocurrency market cap decreased by $50 billion over the past 24 hours, settling at $3.39 trillion. The decline reflects weakening investor confidence amid global macroeconomic uncertainty.

TOTAL appears to be mirroring macroeconomic signals, with recent weekend data offering no clear direction. As global markets absorb bearish economic indicators, the crypto sector faces mounting pressure.

Should sentiment worsen, TOTAL could test its $3.31 trillion support level, reinforcing the broader market’s vulnerability to downside corrections.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

However, improving market conditions could spark a recovery. If capital inflows strengthen and investor optimism returns, TOTAL may breach the $3.42 trillion resistance and climb toward $3.49 trillion.

Bitcoin Remains Close To Support

Bitcoin’s price sits at $101,895, holding slightly above the $101,477 support and remaining dangerously close to the $100,000 threshold. This crucial support zone is preventing Bitcoin from breaking into five-digit territory.

Current market conditions remain uncertain, showing neither clear improvement nor further deterioration. If global markets react negatively to the decline in the consumer sentiment index, Bitcoin could mirror that weakness. A drop below $100,000 could open the door for a further decline toward $98,000 or potentially lower levels.

However, if broader market sentiment stabilizes and risk appetite strengthens, Bitcoin could resist downward pressure and continue consolidating near current levels.

A shift in investor confidence could allow BTC to recover gradually, potentially climbing toward the $105,000 mark.

Filecoin Loses Part Of Its Recent Gains

Filecoin’s price plunged 25% in the last 24 hours, dropping to $2.53 at press time. The correction erased part of last week’s 142% rally, with traders locking in profits as short-term sentiment shifted.

Profit-taking could intensify, dragging FIL toward the $2.26 support or even lower to $2.00. Sustained selling pressure could erase a larger share of recent gains, signaling weakening market confidence.

A failure to defend $2.00 may extend losses further, potentially driving the token into a deeper bearish phase.

However, improved market sentiment could spark a recovery. If investors resist the urge to sell and new inflows emerge, FIL could rebound above $2.63 and push toward $2.99.

A decisive move past this resistance would restore short-term bullish momentum and invalidate the prevailing bearish outlook.

The post Why Is The Crypto Market Down Today? appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Hot crypto: Ethereum Price Prediction: Key $3,300 Support Zone in Focu

Ethereum Price Prediction is back in focus as the world’s second-largest cryptocurrency steadies above a crucial support zone near $3,300 after a sharp 12% pullback over the past week.

ETH briefly dipped to $3,000 on November 4 before rebounding to around $3,400 at the time of writing, suggesting renewed buying interest at lower levels.

The weekly chart indicates that Ethereum faces resistance from its August highs near $4,960 while currently holding around the key 0.618 Fibonacci level at $3,200, a zone that could determine the next major move.

Analysts have revealed that a reclaim of $3,600 would put ETH back in bullish territory, where it can attempt a new high towards $5,000.

On-chain data now shows massive accumulation by whales.

Since October 5th, Ethereum treasury company Bitmine Immersion Technologies has accumulated over 744,600 ETH (worth approximately $2.53 billion).

Ethereum Price Prediction: Bullish Divergence Breakout Targets $4,000 ETH

On the technical front, the Ethereum (ETH/USD) daily chart shows the asset attempting to recover after a notable decline, currently trading near $3,399.

The Fibonacci retracement levels highlight key resistance zones at $3,783 (0.382), $4,231 (0.618), and $4,549 (0.786), indicating possible upside targets if momentum strengthens.

The cluster of exponential moving averages (EMAs) between $3,833 and $4,011 suggests a heavy resistance area; a move above this range could confirm a bullish reversal.

Momentum indicators reveal a potential bullish divergence, as the momentum oscillator forms higher lows while price action trends downward, signaling weakening selling pressure.

This divergence, coupled with the projected pattern, suggests a likely short-term rebound toward the $3,780–$4,000 region.

Ethereum appears to be bottoming out with signs of recovery emerging.

A break above $3,800 could confirm a bullish continuation toward $4,200, while failure to hold above $3,300 risks retesting lower supports around $3,050.

Pepenode Presale Hits $2.09M as Investors Chase 600% Staking Yield

An Ethereum rally back above $4,000 in the short term would bring attention back to ERC20 memecoins, particularly those still in presale.

One of the viral presale projects whales are flocking to right now is Pepenode (PEPENODE), which launched in August and has since raised over $2.09 million from investors.

PEPENODE differentiates itself from typical Pepe meme coins by offering utility beyond viral marketing through its Mine-to-Earn framework.

Unlike traditional mining that demands costly hardware and high electricity consumption, PEPENODE conducts mining by allowing token holders to purchase virtual nodes to earn passive rewards in tokens like Dogecoin and Pepe.

The platform also offers staking with an annual yield exceeding 600%.

With the presale currently underway, early investors can acquire PEPENODE at $0.0011363 before the price increases in subsequent phases.

Interested investors can purchase PEPENODE through the official website using a crypto wallet or bank card.

The post Ethereum Price Prediction: Key $3,300 Support Zone in Focus After 12% Price Pullback – What’s Next? appeared first on Cryptonews.

🔗 Sumber: cryptonews.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!