📌 MAROKO133 Hot startup: Indonesia eyes Sovereign AI Fund 🤖, GoTo records profit 💹

Dear subscribers,

This week’s update captures a mix of funding momentum, regulatory moves, and ecosystem shifts shaping Indonesia’s digital economy. OY! secured fresh capital to scale its fintech infrastructure, while GoTo delivered record-breaking Q2 performance. Regulators are stepping up with new cybersecurity rules for crypto, and Grab Ventures announced its latest startup cohort. Meanwhile, Living Lab Ventures launched InnoLab, Indonesia unveiled plans for a Sovereign AI Fund, and IBM flagged the region’s AI readiness gap.

On the digital infrastructure front, Indonesia’s internet penetration reached 116% in 2025 with 229 million users—yet growth has slowed to just +1.8% YoY, signaling market maturity and shifting the focus to service quality, monetization, and bridging the digital divide beyond Java.

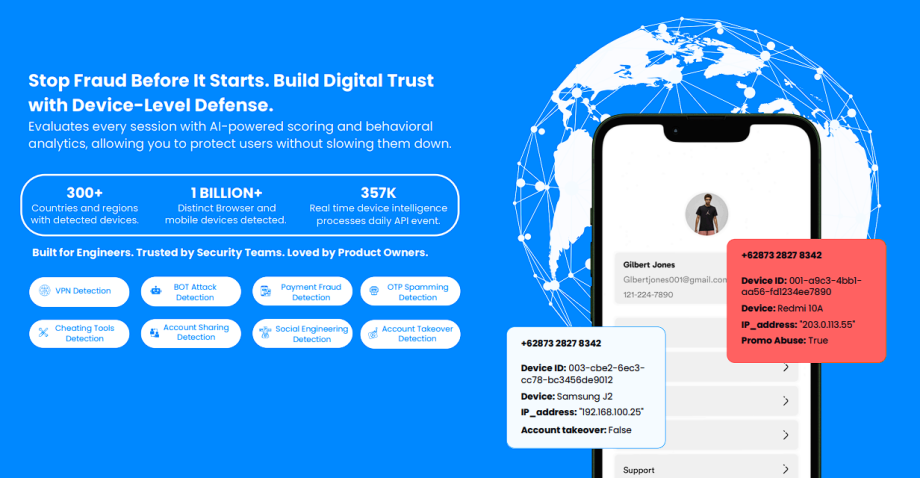

This week’s newsletter is sponsored by Keypaz, an advanced device-level fraud prevention system using fingerprinting, real-time monitoring, and AI risk scoring. Keypaz blocks high-risk devices across billions monitored globally, reducing operational costs, protecting brand reputation, and securing legitimate user experiences. [Try Now].

Keypaz, pioneer of proactive digital fraud defense!

Best regards,

The DailySocial Team

🚨 What’s New

-

OY! secures $15M funding – Indonesian fintech OY! raised US$15M led by MUFG Innovation Partners (MUIP) through their Indonesia’s focused Garuda Fund to strengthen payment infrastructure and expand its product suite. Processing billions in transactions monthly, OY! is positioning itself as a core enabler in Indonesia’s digital payments race. The round signals sustained investor appetite in fintech despite tighter funding. Read more

-

OJK issues cybersecurity guidelines – The Financial Services Authority (OJK) rolled out new cybersecurity rules for digital asset exchanges and custodians. The policy mandates stronger governance, incident response, and data security to curb systemic risks. It reflects regulators’ push to balance innovation with investor protection as crypto adoption rises. Read more

-

Grab Ventures picks five startups – Casion, Jejakin, Liberty Society, Rekosistem, and Sirsak join the Grab Ventures Velocity accelerator. The cohort will gain mentorship, market access, and scaling opportunities through Grab’s ecosystem. Themes include sustainability, social impact, and smart urban solutions. Read more

-

GoTo posts record Q2 2025 performance – GoTo booked 23% YoY revenue growth, its best quarter since IPO, fueled by ride-hailing recovery and fintech expansion. Efficiency gains also narrowed losses, boosting investor confidence in its turnaround. The milestone marks renewed momentum for Indonesia’s biggest tech group. Read more

👏 What’s Exciting

-

WeRide secures investment from Grab to launch robotaxis in SEA – Chinese autonomous driving company WeRide has secured a strategic equity investment from Grab’s partners to accelerate the rollout of robotaxis and autonomous shuttles in Southeast Asia. While Singapore has piloted autonomous taxis in controlled environments since 2016, WeRide’s Grab-backed expansion could mark the first large-scale commercial push for driverless mobility in the region. Read more

-

Living Lab Ventures launches InnoLab – A new program connecting startups with global IP strategy in 5 sectors (health, new gen semiconductor, renewable energy, logistics and climate. InnoLab aims to help founders bridge local research with global opportunities, supporting cross-border scaling. Read more

-

Indonesia plans “Sovereign AI Fund” – Indonesian government is preparing a state-backed AI fund to drive local R&D, support startups, and attract global partnerships. The move underscores Indonesia’s ambition to assert digital sovereignty and compete in the regional AI race. Read more

-

IBM: Only 11% of APAC organizations AI-ready – Despite 85% claiming readiness, only 11% of firms in Asia-Pacific have the infrastructure to scale AI, per IBM. The gap highlights execution risks but also a massive market for enterprise AI solutions. <a href="https://news.dailysocial.id/tech-business/news/studi…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Hot startup: 🧩SaaS leader Mekari acquires Desty. 🏆Sea Ltd back on top.

Dear subscribers,

Indonesia ended the last week in horror as riots erupts across Indonesia driven by political demonstration that turned fatal. The whole weekend was a terrorizing one as riots spreads to smaller regions. Although most of the riots have died down, this week still starts in a rather fearful mood. We wish everyone safe and hope the situation improves soon for everyone

And now, this week’s highlights: funding (Pintarnya, Blitz, Kozystay), platform moves (Mekari, Amartha), and profitability signals (Wagely). Around the region, SeaLtd retakes the top spot by market cap, Atome scales profitably, and ZUZU raises to double-down on AI. Payment rails and rules continue to strengthen supporting Southeast Asia fintech’s march toward ~US$1.1T in 2025.

This week’s newsletter is sponsored by Keypaz, an advanced device-level fraud prevention system using fingerprinting, real-time monitoring, and AI risk scoring. Keypaz blocks high-risk devices across billions monitored globally, reducing operational costs, protecting brand reputation, and securing legitimate user experiences. [Try Now].

Keypaz, pioneer of proactive digital fraud defense!

Best regards,

The DailySocial Team

🚨 What’s New

-

Funding round-up (ID ecosystem):

-

Pintarnya, Indonesia’s jobs & worker-finance platform raised a US$16.7M Series A led by Square Peg, Vertex Ventures, and East Ventures to deepen its tech stack and expand worker financing. Traction to date: 10M+ job seekers, 40K+ employers, nearly 5× YoY revenue growth, breakeven targeted this year, and potential regional expansion. [Read more]

-

Blitz Electric Mobility, Indonesia-based EV logistics enabler closed Pre-Series A led by Vynn Capital with Iterative Capital and new investors including Balaji Srinivasan. In 2024: 3× revenue growth, 70% lower burn. Cumulative stats: 14M+ deliveries, 1,000+ e-motorbikes, 220M km traveled, operations in 30 cities. Indonesia’s courier market is projected to grow from US$7.86B (2025) to US$11.15B (2030). [Read more]

-

Kozystay acquires BaliSuperHost. Shortly after a Series A led by Integra Partners with Cercano Management and Intudo, Kozystay bought BaliSuperHost, the island’s largest premium villa operator. The combined group becomes Indonesia’s largest tech-enabled short-term rental manager with 1,000+ units across apartments, villas, and aparthotels. [Read more]

-

-

Mekari (Indonesia’s most valued SaaS startup) acquired Desty, an omnichannel commerce platform used by thousands of merchants. The move extends Mekari from back-office tools into integrated digital commerce—unifying inventory, orders, warehousing, products, finance, and customer comms in one system. Desty (founded 2021) adds landing pages, online stores, POS, and omnichannel orchestration. Expect faster merchant growth and stronger positioning as an end-to-end SME platform in Indonesia. [Read more]

-

Amartha becomes Amartha Financial Group (ID) to expand beyond micro-lending into payments and micro-investment to strengthen village-level economies (50,000 villages). With backers like IFC and Women’s World Banking, Amartha applies AI-based credit scoring from a decade of community data to deliver inclusive products distinct from urban-centric fintechs—while advancing financial literacy and inclusion for strategic segments such as women. [Read more]

-

Earned wage access platform Wagely reports full profitability, with US$120M+ disbursed across 3.5M transactions and loss rates <0.5%. With 200+ employers (incl. Adira Finance, BAT), Wagely serves 1M+ workers in Indonesia, positioning EWA as an employee benefit (not a loan) to drive recurring revenue. Beyond EWA, Wagely added savings and budgeting, and expanded in Bangladesh. Wagely sees room to apply generative AI for efficiency and worker financial literacy. [Read more]

👏 What’s Exciting

-

Sea Ltd. back at #1 by market cap (SEA)

Sea reclaimed the title of Southeast Asia’s most valuable public company at ~US$111B, edging past DBS (~US$110.3B) after a 300% rally fueled by Shopee outperformance. Cost discipline drove profitability; SPX Express logistics and digital finance are long-term levers. DBS also rallied ~65% on lending and wealth management strength but ceded the top spot. -

Atome Financial delivers profitable scale

2024 operating income: US$236M (+63% YoY); <a href="https://www.atome.id/news/atome-financial-posts-record-us236m-operating-income-marks-full-year-profi…Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

-

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!