📌 MAROKO133 Eksklusif startup: PasarPolis funding 💸, Amazon fuels Astro 🚀, SEA’s c

Dear subscribers,

We’re back with a fresh look at Indonesia and Southeast Asia’s tech and digital ecosystem. From funding moves in insurtech and quick commerce, to bold plays in mobility and infrastructure, the region continues to show resilience and ambition. We also spotlight Indonesia’s push in digital manufacturing and the evolving dynamics of consumer behavior, where opportunities are shifting toward the two ends of the market. As always, our aim is to bring you the signals that matter most for founders, investors, and policymakers navigating this fast-changing landscape.

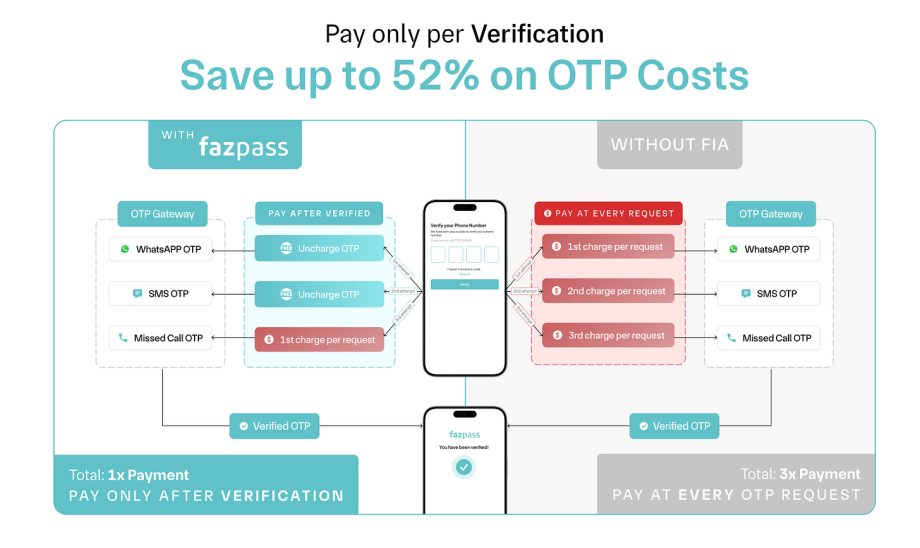

This week’s newsletter is sponsored by Fazpass. Most OTP providers charge per request, making resends and failures costly. Fazpass Intelligence Authentication lets you pay only after a successful verification—cutting costs by up to 52% while ensuring reliable verification through auto-switching across WhatsApp, SMS, or missed calls. [Try Now!]Best regards,

The DailySocial Team

🚨 What’s New

-

PasarPolis secures fresh funding 💸

PasarPolis, Indonesia’s leading insurtech, has raised new funding in an extension round led by Japanese insurance giant Tokio Marine. While the exact figure was not disclosed, sources close to the deal said it was around USD 5 million. The fresh capital will help PasarPolis deepen its presence in Southeast Asia and expand its digital insurance products. -

Amazon backs Astro’s quick commerce push 🚀

U.S. tech giant Amazon has reportedly invested USD 51.9 million in Indonesian quick commerce startup Astro. The move comes just as Amazon officially launched its own 10-minute delivery service in India, signaling stronger ambitions in the region. For Astro, the investment strengthens its financial position in an increasingly competitive market where consolidation is expected.

-

GoTo secures $286M loan facility 💰

GoTo Group has obtained a Rp4.65 trillion (USD 286 million) syndicated loan from DBS Indonesia and UOB. The facility, with a four-year tenor, will be used to refinance existing debt and support general corporate needs, including investment and working capital. As of June 2025, GoTo still had Rp467 billion outstanding from its 2022 loan, which this new funding helps cover. The company emphasized that the loan poses no adverse impact on its operations or financial health, but instead strengthens its liquidity. -

Green SM scales EV taxi service nationwide ⚡🚖

Green SM, the Indonesian EV taxi operator, is accelerating its expansion with three new launches in a single week. The company debuted its service at Soekarno-Hatta International Airport, marking a major step in electrifying airport transport. Soon after, it entered Jakarta’s eastern suburb, Bekasi, broadening coverage in Greater Jakarta’s commuter belt. It also made a strategic move into Makassar, opening access to eastern Indonesia’s economic hub. This rapid rollout reflects Green SM’s ambition to dominate the EV mobility market across the archipelago.

✨ What’s Exciting

-

INA bets big on AI, health, and renewables 🌱🤖

Indonesia’s sovereign wealth fund Indonesia Investment Authority (INA) is sharpening its focus on strategic sectors: digital infrastructure, AI in healthcare, and renewable energy. The fund, now managing USD 10 billion, aims to attract foreign partners and technical expertise to strengthen these industries. INA is diversifying beyond equity into hybrid capital and private credit to support Indonesian companies’ global expansion. This direction aligns with the government’s priorities on data independence, energy transition, and healthcare modernization—areas seen as critical for long-term economic resilience.

-

Indonesia showcases digital manufacturing at Hannover Messe ⚙️🇮🇩

Indonesia showcased its advancements in digital manufacturing at the Hannover Messe 4.0 Expo, highlighting the country’s push toward Industry 4.0 transformation. The showcase highlighted Indonesian smart factory, automation, and digital solutions aimed at boosting productivity and competitiveness. Officials stressed that manufacturing innovation is key to economic growth and positioning Indonesia in the global supply chain, while reaffirming the nation’s commitment to international collaboration in industrial digitalization.

🔮 What’s Next

Latest report by Lightspeed Venture Partners stated that Southeast Asia’s consumer landscape is increasingly shaped by a barbell economy, where the most attractive opportunities lie at the two ends of the spectrum: affluent consumers with spending power…

Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

📌 MAROKO133 Eksklusif startup: 🧩SaaS leader Mekari acquires Desty. 🏆Sea Ltd back o

Dear subscribers,

Indonesia ended the last week in horror as riots erupts across Indonesia driven by political demonstration that turned fatal. The whole weekend was a terrorizing one as riots spreads to smaller regions. Although most of the riots have died down, this week still starts in a rather fearful mood. We wish everyone safe and hope the situation improves soon for everyone

And now, this week’s highlights: funding (Pintarnya, Blitz, Kozystay), platform moves (Mekari, Amartha), and profitability signals (Wagely). Around the region, SeaLtd retakes the top spot by market cap, Atome scales profitably, and ZUZU raises to double-down on AI. Payment rails and rules continue to strengthen supporting Southeast Asia fintech’s march toward ~US$1.1T in 2025.

This week’s newsletter is sponsored by Keypaz, an advanced device-level fraud prevention system using fingerprinting, real-time monitoring, and AI risk scoring. Keypaz blocks high-risk devices across billions monitored globally, reducing operational costs, protecting brand reputation, and securing legitimate user experiences. [Try Now].

Keypaz, pioneer of proactive digital fraud defense!

Best regards,

The DailySocial Team

🚨 What’s New

-

Funding round-up (ID ecosystem):

-

Pintarnya, Indonesia’s jobs & worker-finance platform raised a US$16.7M Series A led by Square Peg, Vertex Ventures, and East Ventures to deepen its tech stack and expand worker financing. Traction to date: 10M+ job seekers, 40K+ employers, nearly 5× YoY revenue growth, breakeven targeted this year, and potential regional expansion. [Read more]

-

Blitz Electric Mobility, Indonesia-based EV logistics enabler closed Pre-Series A led by Vynn Capital with Iterative Capital and new investors including Balaji Srinivasan. In 2024: 3× revenue growth, 70% lower burn. Cumulative stats: 14M+ deliveries, 1,000+ e-motorbikes, 220M km traveled, operations in 30 cities. Indonesia’s courier market is projected to grow from US$7.86B (2025) to US$11.15B (2030). [Read more]

-

Kozystay acquires BaliSuperHost. Shortly after a Series A led by Integra Partners with Cercano Management and Intudo, Kozystay bought BaliSuperHost, the island’s largest premium villa operator. The combined group becomes Indonesia’s largest tech-enabled short-term rental manager with 1,000+ units across apartments, villas, and aparthotels. [Read more]

-

-

Mekari (Indonesia’s most valued SaaS startup) acquired Desty, an omnichannel commerce platform used by thousands of merchants. The move extends Mekari from back-office tools into integrated digital commerce—unifying inventory, orders, warehousing, products, finance, and customer comms in one system. Desty (founded 2021) adds landing pages, online stores, POS, and omnichannel orchestration. Expect faster merchant growth and stronger positioning as an end-to-end SME platform in Indonesia. [Read more]

-

Amartha becomes Amartha Financial Group (ID) to expand beyond micro-lending into payments and micro-investment to strengthen village-level economies (50,000 villages). With backers like IFC and Women’s World Banking, Amartha applies AI-based credit scoring from a decade of community data to deliver inclusive products distinct from urban-centric fintechs—while advancing financial literacy and inclusion for strategic segments such as women. [Read more]

-

Earned wage access platform Wagely reports full profitability, with US$120M+ disbursed across 3.5M transactions and loss rates <0.5%. With 200+ employers (incl. Adira Finance, BAT), Wagely serves 1M+ workers in Indonesia, positioning EWA as an employee benefit (not a loan) to drive recurring revenue. Beyond EWA, Wagely added savings and budgeting, and expanded in Bangladesh. Wagely sees room to apply generative AI for efficiency and worker financial literacy. [Read more]

👏 What’s Exciting

-

Sea Ltd. back at #1 by market cap (SEA)

Sea reclaimed the title of Southeast Asia’s most valuable public company at ~US$111B, edging past DBS (~US$110.3B) after a 300% rally fueled by Shopee outperformance. Cost discipline drove profitability; SPX Express logistics and digital finance are long-term levers. DBS also rallied ~65% on lending and wealth management strength but ceded the top spot. -

Atome Financial delivers profitable scale

2024 operating income: US$236M (+63% YoY); <a href="https://www.atome.id/news/atome-financial-posts-record-us236m-operating-income-marks-full-year-profi…Konten dipersingkat otomatis.

🔗 Sumber: dailysocial.id

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!