📌 MAROKO133 Breaking crypto: $4.5 Billion Bitcoin and Ethereum Options Expire with

Almost $4.5 billion in Bitcoin (BTC) and Ethereum (ETH) options are set to expire at 8:00 UTC today, December 12, 2025.

Today’s expiring options come amid cautious market sentiment as traders navigate thin year-end liquidity and recent macro developments.

Traders Brace for $4.5 Billion Bitcoin and Ethereum Options Expiry After Fed’s Interest Rate Cut

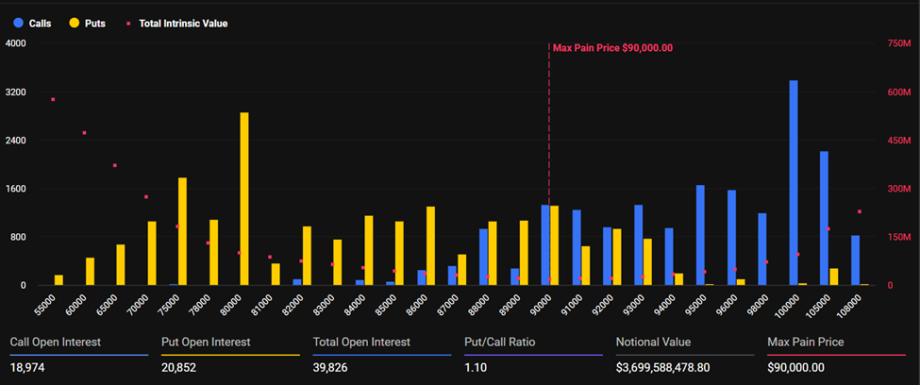

Bitcoin’s current price sits at $92,249, with a “max pain” level of $90,000. The market has 18,974 call contracts and 20,852 put contracts open, totaling 39,826 in open interest. This results in a put-to-call ratio of 1.10 and a notional value of roughly $3.7 billion.

Deribit notes that call and put interest is near balance, suggesting traders expect a contained expiry after recent range-bound action.

“The clustering around $90,000 reflects a market waiting for the next catalyst rather than leaning into directional conviction,” they wrote.

Ethereum, trading at $3,242, has a max pain level of $3,100. Open interest totals 237,879 contracts, comprising 107,282 calls and 130,597 puts, resulting in a put-to-call ratio of 1.22 and a notional value of nearly $770 million.

Deribit analysts observe that while ETH’s positioning has shifted into a more neutral distribution, call concentration above $3,400 indicates traders remain willing to price in potential volatility.

Macro Backdrop Supports Markets, But Caution Prevails

Analysts at Greeks.live note that the Federal Reserve’s recent 25-basis-point rate cut and resumption of $40 billion in short-term Treasury purchases provide liquidity support. Yet, the broader market remains cautious.

“Calling this a QE reboot or the start of a new bull market is premature,” they said, emphasizing that year-end periods historically see the weakest liquidity conditions in crypto.

More than half of open interest is clustered at December 26 expiries, and implied volatility has been trending lower. This suggests subdued expectations for near-term price swings.

The options market shows a persistent negative skew, with puts trading at a premium to calls. This reflects both a stable spot environment that has revived covered-call strategies and ongoing market weakness driving demand for downside protection.

Greeks.live notes that while structural conditions remain soft, traders should remain vigilant for potential upside catalysts, although the probability of sharp moves is low.

Near-Term Risks vs. Long-Term Momentum

Deribit analysts also highlighted short-term pressures from ETF outflows, MicroStrategy losing premium, and miner stress.

“There’s definitely risks in the near term… We’ll need one of those structural things to change,” Deribit wrote, citing Sean McNulty, Derivatives Trading Lead APAC at FalconX.

Despite these near-term challenges, longer-term momentum in both BTC and ETH remains intact, suggesting that the current expiry may be contained unless a new catalyst emerges.

As markets brace for the expiry of $4.5 billion in options, traders appear focused on maintaining balanced positions while monitoring both macro liquidity conditions and crypto-specific catalysts for potential moves into the new year.

In the short term, traders should brace for volatility due to this tranche of expiring options, which could influence market prices into the weekend. However, the market could stabilize thereafter as traders adjust to new trading environments.

The post $4.5 Billion Bitcoin and Ethereum Options Expire with Traders Cautious Ahead of Year-End Moves appeared first on BeInCrypto.

🔗 Sumber: www.beincrypto.com

📌 MAROKO133 Breaking crypto: December Has Barely Started and the Market’s Already

As of Dec. 1, 2025, the crypto market is going through one of those weeks that make even long-time investors hold their breath. Less than 24 hours after dipping below $85,000, Bitcoin suddenly surged to $91,000, and this sharp rebound caught many by surprise and flipped market sentiment almost overnight. Despite Bitcoin still holding a dominant share of the market at around 57%, the whiplash between last week’s drop to the same levels and today’s spike has left new buyers unsure of what to make of these fast swings.

The reason why the picture shifted so quickly was the U.S. Federal Reserve officially ending quantitative tightening and infusing $13.5 billion into the banking system, which turns out to be one of the largest single-day liquidity operations since the pandemic. Some experts now suggest that last week’s pullback may have simply set the stage for an even stronger rally, with today’s jump echoing past moments when volatility preceded major upside moves.

Newcomers should prepare for an even busier week (one filled with important events) but that’s simply how crypto moves. A possible rate cut and Powell’s last public comments before the Fed’s blackout are among the events shaping sentiment. Markets expect easing soon, but analysts remain unsure how quickly that liquidity will flow into crypto.

That’s why the upcoming December 16 EMCD and BeInCrypto Poland webinar feels so timely. It covers the kinds of things people debate before making their first move. Should I hold off and learn more before putting anything in?

Is there a simple way to spread risk so I don’t mess it up? Would it make sense to start with something simple like saving crypto in Coinhold just to see how it works? The sections ahead introduce many of these methods, but a live conversation can sometimes make it easier to understand how they all fit together.

Some readers will feel ready to move forward with the guidance here; others might find the webinar gives them the extra clarity they’ve been looking for.

Tools That Bring a Little Calm Into a Chaotic Market

A lot of people who are new to crypto feel like they’re supposed to jump straight into trading or try to predict the perfect moment to buy. That’s really not the case. There are some simple tools that help you get started without feeling like you’re gambling every time the price moves.

Savings-style tools

A savings-style product basically lets you earn a small, steady reward just by keeping your crypto in one place. Coinhold by EMCD is one example, and with 400,000 people in EMCD’s ecosystem, it’s clear why: it’s simple, steady, and doesn’t require watching charts all day. There are other tools like that out there, but the idea is the same: start slowly, and keep things simple.

Staking services

Another option people try early on is staking, which is nothing complicated. You set aside a bit of crypto and, over time, you earn rewards for doing it. Platforms like Lido or Binance Earn take care of the technical part, so you don’t need to understand every detail to use them.

Crypto indexes

Some beginners feel more comfortable spreading things out instead of picking one coin at a time. That’s where crypto indexes come in. They group several well-known cryptocurrencies together and adjust them in the background, so you’re not constantly deciding what to buy or sell.

Auto-invest and dollar-cost averaging tools

Anyone who doesn’t want to think about timing the market (which is most people), auto-invest tools can help. They let you buy a small amount on a regular schedule and take the pressure off trying to guess the right moment. Binance, Bitget, and OKX all have versions of this, and they’re surprisingly helpful for staying calm when the market gets loud.

None of these are magic solutions, and they don’t remove risk. But they do make those first steps a lot less stressful. And when you’re just getting started, having something steady and predictable in the mix can make a huge difference.

Everything Gets Easier Once the Basics Make Sense

When Bitcoin drops $4,000 in an hour, it’s easy to feel like you’ve missed the boat or made a mistake. This kind of market movement often leaves first-time investors wondering if they should just cut their losses and walk away. However, in times like these, knowledge is the best defense.

The more you understand about how crypto works, the more confident you’ll feel when the market gets shaky, especially on days like today with Bitcoin sliding again. It’s tempting to chase trends or follow the latest hot tip, but the foundation of any good investment strategy is understanding the basics.

Take the time to learn about blockchain technology, how Bitcoin and other cryptocurrencies derive value, and the key concepts such as decentralization and tokenomics. Even knowing how your country regulates digital assets can save you from unnecessary complications down the road.

It’s easy to get carried away, especially when everything feels fast and loud, but that’s when learning the basics really counts. If you can’t explain what a project is for or why it matters, it’s probably not a strong choice. A little understanding goes a long way in keeping you from panic-selling or following the crowd.

Avoid Both the Noise and the Hype

Crypto markets are loud: nonstop hype, chatter, and “big opportunity” talk. Add in a week with major Fed decisions, rate-cut speculation, and important economic reports, and it gets even harder to separate real information from noise.

It’s easy to get pulled in by the noise, but tuning it out matters. When the market moves fast, people often rush toward whatever coin is suddenly trending or being hyped online, and that’s usually when mistakes happen. Jumping on the latest “hot tip” often means buying at the worst possible moment, either after the price has already shot up or right before it drops again.

Instead of reacting to every market shift or social media post, focus on sticking to a strategy that’s grounded in your research and long-term goals. When you feel that urge to jump into a new coin or react to a sudden price movement, take a step back. The best way to avoid the pitfalls of hype is to remember that successful investing is about steady, thoughtful decisions based on what you know.

Forget Making Ten-Fold Gains Overnight

The promise of quick, massive returns is one of the biggest draws to crypto, but it’s also one of t…

Konten dipersingkat otomatis.

🔗 Sumber: www.beincrypto.com

🤖 Catatan MAROKO133

Artikel ini adalah rangkuman otomatis dari beberapa sumber terpercaya. Kami pilih topik yang sedang tren agar kamu selalu update tanpa ketinggalan.

✅ Update berikutnya dalam 30 menit — tema random menanti!